Papeda EA SOURCE CODE

65.9 KB

Papeda EA.mq4

Papeda EA.ex4

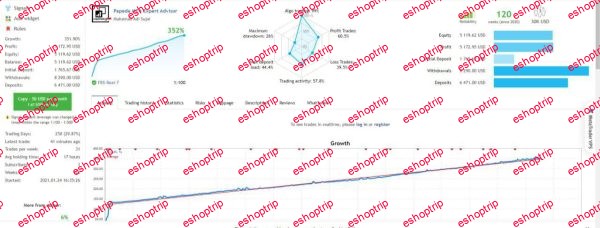

https://www.mql5.com/en/signals/1086471

Papeda EA with its more than three years of stable profits and relatively low retracement has attracted the attention of netizens, this EA my personal evaluation can be considered a middle to upper grade EA, not considered fine, but the strategy more than ordinary Martin strategy, the reasons are as follows:

1:Although it is a Martin, but you can set the maximum floating loss ratio, this function should actually be every Martin nature of EA should have the function, the code is very simple to achieve, but most of the Martin EA does not have this function;

2. EA orders can be closed through the panel, for EA strategies, the trading panel is a very recommended feature, but this EA does not write the relevant keys to place orders, almost something;

3. In the case of a one-way position, if the trend of the market changes, the EA will open a position opposite to the current position, for subsequent hedging, but the EA does not play out the value of two-way hedging;

The design of the EA’s position spacing is also very good, although it is very simple is a matter of code, but it can effectively should be a rapid rise in the market, simple but effective.

The source code of this EA, I have not yet begun to analyze, the above content is obtained through back-testing analysis, only for your friends reference it

The author does not specify the time frame used in this EA, but only clarifies that this EA is designed for the EURUSD trading instrument. I have analyzed the signals of this EA and feel that the applicable time period for this EA is H1, for your reference

EA Official Profile

EA Papeda is a full automatic trading system base on martingale on pair EURUSD only. Minimum balance to trade with this EA (to copy the trade) is:

1. Leverage 1:500 minimum $2000

2. Leverage 1:200 minimum $3000

3. Leverage 1:100 minimum $5000

The strategy is:

#1 – Place an order according to the direction of the market trend.

#2 – Orders will be placed if there has been a price correction.

#3 – If the price correction remains against the market trend, it will do martingale to accelerate reaching the profit target.

#4 – If the existing order has not reached the profit target while the market trend has changed, then hedging will be carried out as a safety of funds. If all buy and sell orders have reached the set profit target, the EA will close all orders.

#5 – If all active orders have recorded a loss of up to 25% of equity, then all orders will be closed completely for safety of funds then will look for new opportunities and new orders at the next opportunity.