Published 7/2024

Created by Mia Le, EA, MBA

MP4 | Video: h264, 1280×720 | Audio: AAC, 44.1 KHz, 2 Ch

Genre: eLearning | Language: English | Duration: 16 Lectures ( 1h 35m ) | Size: 1.64 GB

Step-by-Step Instructions for Completing Form 8824 Like-Kind Exchange w/ Confidence for Real Estate Investors/Homeowners

What you’ll learn:

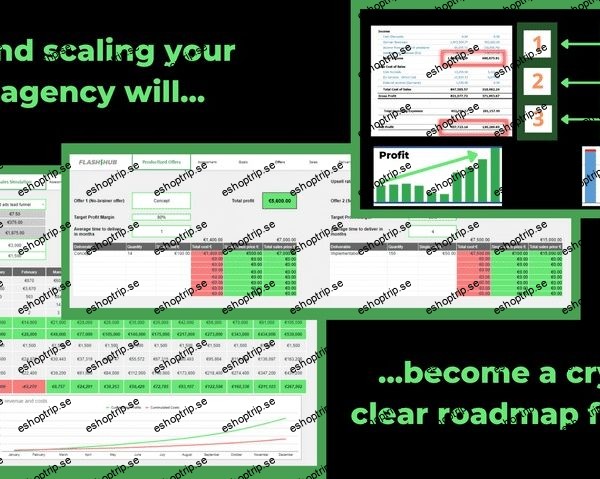

MASTER FORM 8824 COMPLETION: Seamlessly navigate Form 8824 for tax advantages and compliance, setting the stage for financial success.

NAVIGATE TURBOTAX WITH EASE: Effortlessly report exchanges in TurboTax for maximum benefits and minimal stress.

CONQUER EXCHANGE CHALLENGES: Handle complex scenarios with confidence, ensuring smooth sailing on your path to tax mastery.

OPTIMIZE BENEFITS, ENSURE COMPLIANCE: Maximize tax benefits while maintaining IRS compliance, unlocking your full financial potential.

CALCULATE DEPRECIATION AND BASIS: Gain expertise in accurately calculating depreciation and basis for the property given up, maximizing your tax advantages.

ENTER NEWLY ACQUIRED PROPERTY IN TURBOTAX: Learn to seamlessly enter newly acquired property into TurboTax, calculating basis and depreciation.

ENJOY CONFIDENCE: Mia, an Enrolled Agent, guides your learning journey, ensuring confidence and setting you up for success.

PEACE OF MIND GUARANTEED: Rest assured with our Udemy 30-day money-back guarantee, ensuring your satisfaction.

Requirements:

Basic Understanding of Real Estate Transactions: Familiarity with the basics of buying, selling, or investing in real estate will be helpful but not mandatory.

Access to TurboTax: Ensure you have access to TurboTax Online to follow along with the course tutorials.

Description:

Welcome to the Ultimate Guide to Mastering 1031 Exchange Reporting with Confidence in TurboTax!Are you a savvy real estate investor or a meticulous tax professional seeking to conquer the complexities of Like-Kind Exchanges effortlessly? Look no further!Please note that this course is based on US Tax Laws.Also note that this is for TURBOTAX ONLINE. If you use TurboTax Desktop, the process is similar but it is not exactly the same, follow a long but note that we do not provide step-by-step instruction for the desktop version.Introducing “1031 Exchange: How to Report in TurboTax”In this power-packed course, I, Mia Le, an Enrolled Agent with over 15 years of tax expertise, unveil the secrets to mastering Form 8824 and navigating TurboTax like a pro! As a passionate real estate investor myself, I understand the intricacies of the market and tax landscape, ensuring you receive top-notch guidance tailored to your needs.Unlock the Key to Tax SuccessComprehensive Insights: Say goodbye to fragmented knowledge! Unlike scattered YouTube videos, this course delves deep into the legal framework, practical applications, and step-by-step instructions for completing Form 8824.TurboTax Mastery: Tackle tax reporting with ease as you learn to handle complex exchange scenarios and maximize tax benefits using TurboTax. Save both time and money with our streamlined approach!Expert Guidance: With my extensive experience and dedication to empowering students, you’ll gain unparalleled insights into like-kind exchanges, ensuring you confidently navigate the realm of real estate taxation.Transform Your Financial Journey Today!What You’ll LearnUnderstand the legal and practical aspects of like-kind exchanges. Accurately complete Form 8824 with ease. Navigate TurboTax effortlessly to report like-kind exchanges. Handle complex exchange scenarios with confidence. Apply best practices to maximize tax benefits and compliance.Course Curriculum HighlightsIntroduction to Like-Kind Exchanges: Lay the foundation for your tax success. Utilizing TurboTax for 1031 Like-Kind Exchanges: Master the art of tax reporting. Tax Planning with TurboTax: Strategize for financial efficiency. Advanced Topics: Suspended Passive Losses: Elevate your understanding of tax intricacies. Q&A: Get expert answers to your burning questions.Benefits Beyond MeasureSave capital gain tax on rental home sales effortlessly. Gain peace of mind and confidence in executing tax strategies. Navigate TurboTax with precision and save valuable time. Enjoy cost savings with TurboTax’s affordability and efficiency.Why Choose Us?Comprehensive Approach: We bring together fragmented knowledge into a cohesive learning experience. Ease of Understanding: Complex concepts are broken down into logical modules for seamless comprehension. Expert Instructor: Learn from a seasoned Enrolled Agent with a proven track record of empowering students to achieve financial success.Join Us on the Path to Tax Mastery! Enroll Now and Ignite Your Financial Future!Unlock the doors to tax efficiency and financial empowerment today. Your journey to tax mastery begins here!DISCLAIMER: The information and guidance offered on this website are intended solely for educational and general informational purposes. Mia Le and Strategy Street Smart expressly disclaim any responsibility for any direct, incidental, consequential, indirect, or punitive damages that may result from accessing or using any of the content accessible through this platform. Prior to making any investment decisions, it is strongly advised that you seek guidance from a qualified financial advisor or another professional specializing in wealth management.While Mia Le and her associated entities exercise due diligence to maintain the accuracy and currency of the content on this platform, all information provided herein is presented “as is” without any warranties or representations of any nature regarding its accuracy or appropriateness for your specific needs.Any hyperlinks leading to external websites are included solely for convenience, and Strategy Street Smart urges you to review the privacy policies of such third-party websites.

Who this course is for:

Real Estate Investors

Tax Professionals and Advisors

Accountants Specializing in Real Estate

Financial Planners and Advisors

Homepage