Published 3/2024

MP4 | Video: h264, 1920×1080 | Audio: AAC, 44.1 KHz

Language: English | Size: 276.81 MB | Duration: 0h 46m

Learn Investment banking,valuation,Finance and be expose to the skills, roles and opportunities to succeed in the career

What you’ll learn

How to start a career in investment banking as a new bie and how to advance your career as a professional

Understand the difference between investment banks and commercial banks

Understand why companies go public

Take you career to the next level

Build valuation models-DCF,LBO and multiples

Understand valuation and how it works.

Understand the essence of restructuring sevices

Requirements

Absolutely no experience is required. we will start with the basics knowledge you need to have at the foundation stage.

A willingness to learn

Description

Welcome to the exciting world of investment banking! In this comprehensive course, “Introduction to Investment Banking for Beginners,” we’ll embark on a journey to unravel the mysteries of one of the most dynamic sectors in the financial world.Have you ever wondered what investment banking is all about? Or perhaps you’re eager to explore the inner workings of Wall Street and beyond? Look no further! Our course is designed with YOU in mind, offering a step-by-step guide to understanding the fundamentals of investment banking.Throughout this immersive learning experience, you’ll delve into the core concepts and principles that underpin the investment banking industry. From its historical evolution to its pivotal role in shaping global financial markets, we’ll leave no stone unturned.But we won’t stop there. Our mission is to equip you with the knowledge and skills necessary to thrive in this fast-paced environment. Whether you’re interested in capital raising, mergers and acquisitions, or risk management, we’ve got you covered.Through engaging lessons, real-world case studies, you’ll gain practical insights into the day-to-day operations of investment banks. From client prospecting to deal structuring, you’ll learn the ropes from industry experts who’ve been there and done that.But that’s not all! We’ll also focus on your professional development, offering guidance on resume writing, interview preparation, and networking strategies. Because at the end of the day, our goal is simple: to empower you to pursue a rewarding career in investment banking.In this course, we’re not just going to scratch the surface; we’re going deep into the heart of investment banking. Here’s what you can expect to achieve:1. **Foundational Knowledge:** We’ll kick things off with an overview of investment banking, tracing its historical roots and exploring its vital role in today’s financial landscape. You’ll gain a solid understanding of key players, regulatory frameworks, and ethical considerations shaping the industry.2. **Understanding Financial Markets:** Get ready to navigate the maze of financial markets and instruments. We’ll demystify equities, bonds, derivatives, and more, while unraveling the roles of various market participants. Plus, we’ll introduce you to essential valuation techniques to help you make informed investment decisions.3. **Exploring Investment Banking Functions:** Ever wondered how investment banks help companies raise capital or facilitate mergers and acquisitions? Wonder no more! We’ll delve into the nuts and bolts of capital raising, M&A, and advisory services, equipping you with the tools to tackle real-world transactions.4. **Mastering the Investment Banking Process:** From client prospecting to deal execution, we’ll walk you through each stage of the investment banking process. You’ll learn how to conduct due diligence, build financial models, and negotiate deals like a seasoned pro.5. **Navigating Risk Management:** No discussion of investment banking is complete without addressing risk. We’ll examine market, credit, and operational risks, along with strategies to mitigate them. Plus, we’ll delve into the ever-important realm of regulatory compliance and risk governance.6. **Unveiling Valuation Techniques:** Valuation lies at the heart of investment banking. In this module, we’ll explore advanced valuation methodologies, including DCF analysis, CCA, and LBO modeling, giving you the tools to assess the worth of any asset or company.7. **Real-World Applications:** Theory meets practice in this module, where we’ll dissect real-life investment banking transactions. Through case studies and guest lectures from industry insiders, you’ll gain invaluable insights into the complexities of deal-making.8. **Charting Your Career Path:** Finally, we’ll turn our attention to your professional growth. Whether you’re eyeing a career in investment banking or simply want to bolster your financial acumen, we’ll provide guidance on resume building, interview strategies, and networking tactics to help you stand out in a competitive field.So, are you ready to embark on this exhilarating journey into the world of investment banking? Enroll now and let’s make your financial dreams a reality!Lets get started.

Overview

Section 1: Introduction to Investment banking

Lecture 1 Introduction

Section 2: Understanding Financial Market and Instrument

Lecture 2 Understanding Financial Market and Instrument

Section 3: Investment Banking Functions

Lecture 3 Investment banking funtions

Section 4: Investment Banking Process

Lecture 4 Investment Banking Process

Section 5: Risk Management in Investment Banking

Lecture 5 Risk Management in Investment Banking

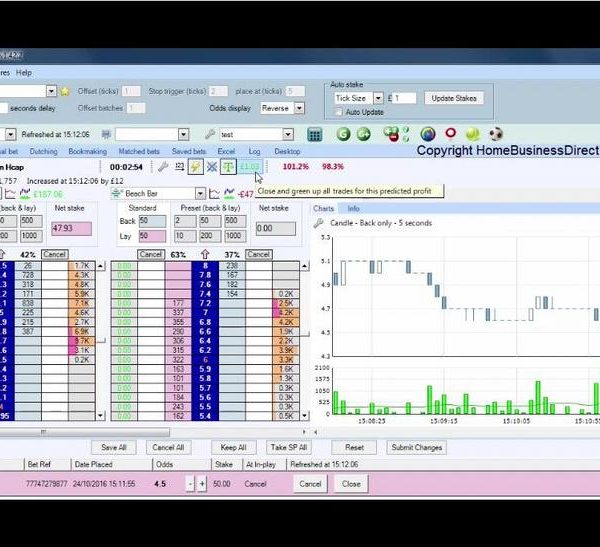

Section 6: Valuation Techniques

Lecture 6 Valuation Techniques

Section 7: Investment banking in practice

Lecture 7 Investment Banking in Practice

Section 8: Career Paths in Investment Banking

Lecture 8 Career Paths in Investment Banking

Introduction to Investment banking is a dynamic investment banking course that introduce to the foundational knowledge you need to have as an investment banker or aspiring investment banker. from the very basics and beginnings.

Homepage

https://anonymz.com/?https://www.udemy.com/course/introduction-to-investment-banking-for-beginners/