Last updated 7/2024

MP4 | Video: h264, 1280×720 | Audio: AAC, 44.1 KHz, 2 Ch

Language: English | Duration: 10h 22m | Size: 2.81 GB

Unlock the Secrets of Investor Psychology and Make Informed Financial Decisions with Behavioral Finance Mastery

What you’ll learn

Understand the link between psychology and finance.

Identify how cognitive biases affect investment choices.

Mitigate overconfidence in financial decisions.

Recognize and manage loss aversion.

Understand the impact of anchoring on investment.

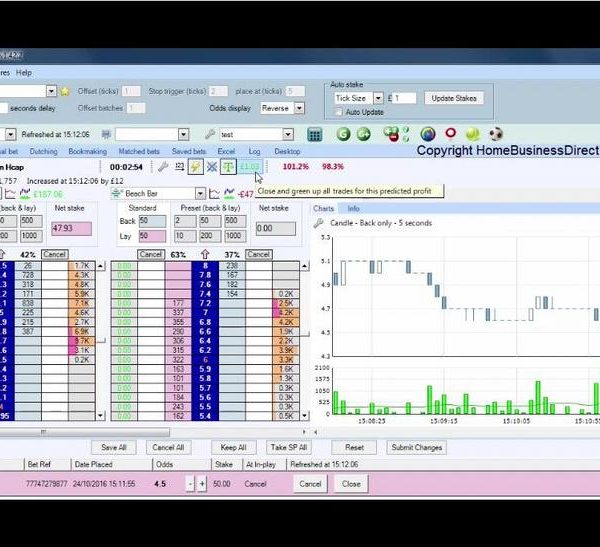

Analyze emotional factors like fear and greed in trading.

Develop strategies to maintain emotional discipline.

Apply behavioral finance principles to real-world scenarios.

Analyze historical market events using behavioral insights.

Implement practical techniques to enhance investment strategies.

Learn from expert instructors in behavioral finance

Engage with a community of like-minded investors.

Progress at your own pace with flexible course structure.

Develop a toolkit for rational financial decision-making.

Enhance personal and professional growth through behavioral finance.

Requirements

No Prerequisites.

Description

This comprehensive course is meticulously designed to bridge the gap between psychology and finance, providing you with a profound understanding of how cognitive biases and emotional factors influence investment choices. By delving into the realm of behavioral finance, you will unlock the secrets of investor psychology, equipping yourself with the tools to navigate the complexities of the financial markets with confidence and precision.Imagine a world where your investment decisions are not clouded by fear, overconfidence, or herd mentality. Instead, they are informed by an acute awareness of the psychological forces at play. This course offers you the unique opportunity to master the art and science of behavioral finance, transforming the way you approach investments. Our curriculum is thoughtfully structured to guide you through the theoretical foundations of behavioral finance, followed by practical insights and applications that you can immediately implement in your investment strategy.At the heart of this course lies a deep exploration of the cognitive biases that often lead to suboptimal financial decisions. You will gain a nuanced understanding of how biases such as overconfidence, loss aversion, and anchoring can skew perception and judgment. Through engaging lectures and real-world examples, you will learn to recognize and mitigate these biases, enhancing your ability to make rational and effective financial decisions. This knowledge is not just theoretical; it has the potential to significantly impact your investment performance and financial well-being.Moreover, this course delves into the emotional aspects of investing. Emotions such as fear and greed can have a powerful influence on market behavior, often leading to irrational decision-making. By studying the psychological factors that drive these emotions, you will develop strategies to manage and harness them to your advantage. Our expert instructors will provide you with practical techniques to maintain emotional discipline, allowing you to stay focused on your long-term financial goals even in the face of market volatility.One of the distinguishing features of this course is its emphasis on real-world applications. We understand that theoretical knowledge alone is insufficient; therefore, we incorporate case studies and interactive exercises to bring the concepts to life. You will have the opportunity to analyze historical market events through the lens of behavioral finance, gaining insights into how psychological factors influenced the outcomes. This hands-on approach ensures that you not only understand the theory but also know how to apply it effectively in your investment practice.Our course is designed to cater to a diverse audience, from individual investors seeking to enhance their personal investment strategies to financial professionals aiming to gain a competitive edge in their careers. Regardless of your background or experience level, you will find the content accessible and enriching. The course structure allows you to progress at your own pace, providing flexibility to accommodate your schedule while ensuring a comprehensive learning experience.By the end of this course, you will have developed a robust toolkit for making informed financial decisions. You will be adept at identifying and mitigating cognitive biases, managing emotional influences, and applying behavioral finance principles to real-world scenarios. This mastery will empower you to approach the financial markets with a heightened sense of awareness and strategic acumen, ultimately enhancing your investment outcomes.The impact of this course extends beyond your personal financial gains. As you develop a sophisticated understanding of investor psychology, you will be better equipped to advise and guide others in their financial decisions. Whether you are a financial advisor, portfolio manager, or simply someone passionate about investing, the knowledge you gain from this course will position you as a trusted and insightful resource in the field of finance.Enrolling in this course is an investment in your future. The skills and insights you acquire will not only enhance your financial decision-making but also contribute to your overall personal and professional growth. You will become part of an elite group of individuals who understand the profound connection between psychology and finance, setting yourself apart in a competitive landscape.We invite you to embark on this transformative journey and discover the power of behavioral finance. By mastering the psychology of investing, you will unlock new opportunities for financial success and personal fulfillment. Take the first step towards making more informed, rational, and successful investment decisions. Join us and become a pioneer in the field of behavioral finance. Your future self will thank you.

Who this course is for

Individual investors aiming to improve their personal investment strategies

Financial advisors seeking to provide better guidance to their clients

Portfolio managers wanting to enhance their decision-making processes

Traders looking to understand and mitigate cognitive biases

Wealth managers aiming to balance emotional influences in market decisions

Finance students interested in practical applications of behavioral finance

Investment analysts seeking insights into investor psychology

Financial planners wanting to advise clients on emotional discipline

Risk managers aiming to incorporate behavioral insights into risk assessments

Academics researching the intersection of psychology and finance

Financial consultants looking to add behavioral finance to their toolkit

Economics enthusiasts eager to explore the psychological aspects of markets

Corporate finance professionals aiming to improve strategic investments

Business leaders wanting to understand market behavior dynamics

Investors passionate about making more informed and rational decisions

Homepage

https://www.udemy.com/course/mastering-behavioral-finance-psychology-of-investing/