Published 12/2023

MP4 | Video: h264, 1920×1080 | Audio: AAC, 44.1 KHz

Language: English | Size: 11.60 GB | Duration: 6h 1m

A journey through the history of finance, the exciting and the mundane topics, and learning how to invest by yourself.

What you’ll learn

Create an investment plan and execute effectively

Identify market opportunities and timing of your investments

Understand the history of the stock market

Feel confident discussing complex financial innovations from options trading to cryptocurrencies

Requirements

No financial background necessary.

Description

It’s 3 pm on a February afternoon and your bank calls you, “Have you made your RRSP contribution for the year? Mr. Smith, I’d like to help you earn 10 %/year and reduce your taxes by opening a new account. Can I book you in for an appointment next Monday?”I’ve made that phone call before; I understand your hesitations – maybe you think these returns aren’t realistic, the fees are too high, you wonder if I have a conflict of interest, I can’t possibly understand your situation – and it all seems too complicated.Forget about the banks managing your money – you can do it better yourself.That’s where this course comes in.During this course, we will begin a journey learning all the basics and more about finance from the products (stocks, bonds, mutual funds) to the accounts (TFSA, RRSP, RESP, etc.) to open your first brokerage account and feel confident developing an investment plan and following through on it day in and day out.What I hope you gain from this course is an excellent understanding of how to invest by yourself, understand the role that finance plays in the world, and develop the confidence to develop a plan and stick with it. In addition, we’re going to get excited about finance and you will learn how to engage in some intelligent discussions with your friends about stocks, crypto, options trading, developing an opinion on the Central Bank and the State of the Economy and so forth. It will be fun, I promise, and the investment you make in continuous learning is the best you will ever make. Taking this course will also pay you dividends for years to come! By investing by yourself and not through a bank, you will have access to vast investment opportunities at lower fees, easily amounting to a 2% annual difference, which can translate to tens of thousands of dollars over your lifetime.If you’ve made it this far, don’t hesitate, sign up today and let’s begin!

Overview

Section 1: Assets, Accounts and Alpacas

Lecture 1 An Overview of a Plethora of Asset Classes

Lecture 2 Broadly Diversify into Mutual Funds and Exchange Traded Funds

Lecture 3 Opening your Own Offshore Tax Haven Account

Section 2: Execution, Execution, Execution: How to get Started and How to Keep Momentum

Lecture 4 Take our your Notepad, We’re Creating an Investment Plan!

Lecture 5 Straight Execution

Lecture 6 Walking onto the New York Stock Exchange Floor

Section 3: Bulls, Bears, Bots, Bubbles: Understanding the Stock Market

Lecture 7 A History of Human Evolution, Obsessed by Greed and Ingenuity

Lecture 8 The Players of the Most Exciting Game on Earth

Lecture 9 The Good, The Bad, and The Damn Ugly

Section 4: The Sophisticated Investor: Reading Charts, Newspapers and Financial Statements

Lecture 10 How the Stock Market Works like a Drunken Sailor

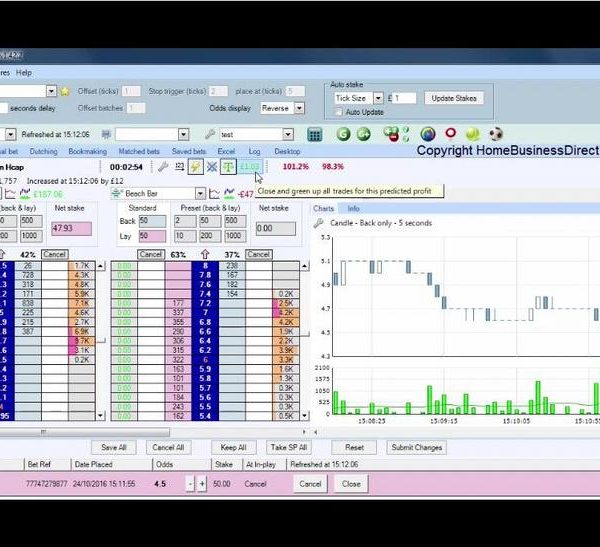

Lecture 11 The Man’s Horoscopes: Reading the Charts

Lecture 12 So You Think You Found a Good Stock

Lecture 13 Sound Smart with Financial Jargon

Section 5: The Exciting Topics: Options Trading, Cryptocurrencies, Booms and Busts

Lecture 14 Lose It All with Options Trading

Lecture 15 Hacks, Fraud, Rug-pulls and the Future of Money with Cryptocurrencies

Lecture 16 The Mania That Lasted Over 400 Years

Lecture 17 The Everything Bubble

Lecture 18 Gamestop Wont Stop

Lecture 19 Predicting the Future

Beginning Finance Professional that wants to gain a more nuanced understanding of the discipline,Anyone that wants to take control of their own financial planning

Homepage

https://anonymz.com/?https://www.udemy.com/course/the-nuts-and-bolts-of-self-directed-investing/